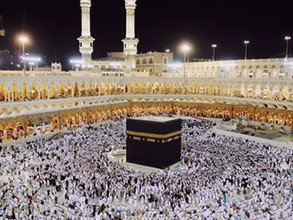

Meezan Kafalah is a Takaful (Islamic Insurance) plan through which customers can save for their future plans such as education or wedding of their child, going for Hajj, planning for old age etc. Meezan Kafalah is a Shariah-compliant alternative to bancassurance with easy exit option at any time.

* 5% Wakalah fee and Takaful expense on actual rate applicable.

Meezan Kafalah is a recurring deposit plan, where you, as a customer, will pay your contribution regularly The Bank will pay profit on your deposited amount while the Takaful partner will provide Takaful cover.

Bank will share 50% of Gross Income as Mudarib

Depositor will share 50% of Gross Income as Rab-ul-Maal

| Products | Tier Groups | Weightage Assigned |

|---|---|---|

| Meezan Kafalah | Monthly | 0.45 |

| Products | Tenure | Profit Assigned |

|---|---|---|

| Meezan Kafalah | Monthly | 7.28% |

*5% WAKALAH fee on first year permium and Takaful expense on Takaful covered at actual basis.

Meezan Bank, acting as a facilitator, will forward the customer’s case to the Takaful company. The claim acceptance, processing and payment are sole responsibility of the Takaful company, and Meezan Bank shall not be liable for any grievances the customer may have with respect to Takaful coverage whatsoever.

Accidental Death Benefit

In case the individual covered suffers from accidental death the Takaful coverage amount of the Kafalah shall be double the coverage amount.

Example

Mr. Asad has subscribed a 10 year Kafalah plan for his son’s education. His annual contribution is Rs. 100,000/-. In case of natural death, his Takaful coverage shall be 10 years * Rs.100,000/- = 1,000,000/- & in case of accidental death the Takaful coverage shall be Rs.2,000,000/-

In case of the customer’s death, a sum of the cash value (invested amount along with the profit earned) and the Takaful cover shall be paid.

*The cash value will be paid by Meezan Bank to the legal heirs in accordance with the Bank’s deceased policy.

*Takaful cover will be paid by Takaful Company, as Hiba to the nominee.

What is 100% Accidental Death Benefit (ADB)?

Incase the customer's death is due to an accident then 100% of life Takaful cover will be paid additionally as Accidentally Death Benefits (ADB).

All individuals in the age bracket of 18-55 years. Maximum age till maturity is up to 60 years.

The initial investment required is Rs. 2,000/- only.

Minimum investment is Rs. 24,000 per year or Rs. 2,000 per month

Meezan Kafalah works on the underlying contracts of Mudarabah and Wakalah.

In Mudarabah, funds deposited by the customer are allocated to a deposit pool, which are invested strictly in Islamic modes of finance.

In Wakalah, the customer will agree to appoint Meezan Bank as his/her Wakeel (agent) for facilitation in the collection of Takaful cover contribution, whereby the Bank may, acting as a collection agent, collect Takaful cover contribution i.e Takaful expense amount from the customer and change WAKALAH fee inlieu of providing Takaful coverage, which on Bank’s sole discretion, WAKALAH FEE may be waived after 3 or more years of WAKALAH period.

Fill out the form below and you will be contacted by a Meezan Kafalah representative.